For over three decades, helping clients and businesses vision their financial future

Objective Consultative Approach

At the EHR Financial Group, we believe that sound communication and education fosters an environment for growth and success. It can also result in more proactive and thoughtful decisions. EHR Financial Group brings insight and expertise to the implementation of financial strategies that seek to advance and protect a lifetime of investment assets.

EHR Financial Group supports a diverse and varied clientele, from business owners and executives to retirees and individual investors. We embrace this diversity because it allows us to continually enhance our skills and depth of knowledge to meet the vast array of needs our clients present.

Our experiences and financial insights are shared with you to help you address critical questions about investing. In addition, we work with you to identify an investment plan and select investment strategies that can help you accumulate assets, preserve assets through risk management, and distribute retirement income.

Deliver Quality Investment Solutions to Our Clients

After gathering information through our consultative approach, we use innovative thinking, insightful guidance and practical advice, to deliver the individual account strategies you seek and the outstanding service you require. We have a range of options that help us serve your investment needs. Securities are offered by PFS Investments Inc., with investments products that include Mutual Funds, Variable Annuities, Small Business Retirement Plans, IRA’s, both traditional & Roth, and 529 Plans. Fee-based Managed Accounts are offered through Primerica Advisors.

Our mission is focused on getting to know and understand your needs, wants, and long-term goals. Our passion is to help you develop and implement an investment plan that’s designed to address your individual situation. Our energy, commitment, and efforts are focused on you, the client, and your satisfaction.

Ongoing servicing of you and your accounts is critical to us. We are committed, as individuals and as a team, to being accessible to support you in your investment decisions and to work with you to implement changes as they become necessary.

EHR LEADERSHIP TEAM

Ed Randle

Founder of EHR Financial Group

Email: Edrandle@primerica.com

Ed started his financial services career in 1964 as a financial planner with a nationally-recognized insurance company in Birmingham, Alabama. Ed still calls Birmingham home to business and his personal life. In 1973, Ed founded his financial services practice that would become EHR Financial Group. For over 45 years, Ed and his team have served thousands of clients in providing value-added insurance and investment products and services to families and business owners across North America. Ed focuses his efforts today on maintaining a close relationship with EHR’s team members.

Stacy Randle Murdoch

Regional Vice President, Birmingham

Series 6, 63, 65, and 26

Investment Adviser Representative

Email: smurdoch@primerica.com

Stacy is the daughter of Ed Randle and joined the firm in the early 1990s. Stacy focuses on servicing personal clients and business development. She is very committed to helping her clients identify and achieve their goals. She is very process-oriented and implements a financial planning approach with her clients. Stacy serves as a mentor to EHR teammates and focuses much of her time on helping other women find their success path and working with other charitable causes.

Bill Vandiver

Regional Vice President, Birmingham

Series 6, 63, 65, and 26

Investment Adviser Representative

Email: Bill.vandiver@primerica.com

Bill is the son of Ed Randle and joined the firm in the early 1990s. Bill is very committed to ensuring that the home office is providing superior service and support to the advisors and clients. Client servicing, operations, compliance are focal points every day to ensure that the firm is successful in the delivery of solutions and services.

Over the years, Ed, Stacy, and Bill have developed core investment beliefs and client-servicing beliefs. These beliefs are incorporated into the process that everyone affiliated with EHR Financial Group seeks to implement with their clients.

For additional information about an advisor, including licenses and state registrations, please visit www.BrokerCheck.com.

The EHR Financial Group Team

Keith Whetter

Regional Vice President; Birmingham, AL

Series 6, 63, 65

Investment Adviser Representative

Phone: 602.418.1483

Email: kwhetter@primerica.com

Keith began his career with Oldsmobile Division of General Motors and held positions in both sales and service in St. Louis, Houston, Phoenix, and Lansing, MI. In June, 2002, Keith launched his career in Financial Services in Scottsdale, AZ. Keith discovered a passion for helping his clients save for their future goals and retirement. Keith relocated to Birmingham, AL in 2012 where he joined the EHR Financial Group and works out of the Hoover, AL office location. Being able to listen to his clients, discover their goals and connecting them to the solutions that fulfill their needs is the most satisfying part of being an advisor to Keith.

Daniel Szatkowski

Regional Vice President, New York, NY

Series 6, 63 and 26

Investment Adviser Representative

Phone: 917.704.9905

Email: dszatkowski@primerica.com

Daniel Szatkowski , a graduate of the University of Szczecinski (Poland) – Economic & Management School, started his financial services career in 1997 as Personal Banker at Bank of Pekao SA (Poland). He joined the EHR team in 2008, and over the past 10 years, he has helped clients to become properly protected and to build wealth for retirement and educational purposes.

Gerald Reid

National Sales Director, Tampa, FL

Series 6, 63, 26, 65

Investment Adviser Representative

Office Phone: 813.315.9861 Cell Phone: 813.833.1013

Email: greid.4284504@primerica.com

Gerald started his Financial Services career in 1981. After spending 11 years in Indiana, he and his family moved to Tampa, Florida in 1992. Gerald is focused on helping families protect their income with term life insurance, making sure they have access to top-quality investment solutions for all stages of their life am dedicated to helping individuals and small businesses achieve their financial goals. His experience and financial insights are shared to help you address critical questions about investing. In addition, he will work with you to identify an investment plan and select investment strategies that can help you accumulate assets, preserve assets through risk management, and distribute retirement income.

For additional information about an advisor, including licenses and state registrations, please visit www.BrokerCheck.com.

The EHR Financial CLIENT SERVICE Team

(From left to right) Linda Gould, EHR Communications; Lisa Gibbs, EHR Administration; Morgan Holladay; Loma Husband, EHR Office Manager

At EHR Financial Group we take pride in servicing our clients. Linda, Lisa, Morgan, and Loma lead our client servicing efforts and ensure that we are always available to address your needs. We believe in having the most open and active communication possible. This enables us to assure that you are on track for your goals and objectives and we are responsible for any questions or concerns you have.

BEST IN CLASS INVESTMENT SOLUTIONS OFFERED THROUGH PFS INVESTMENTS INC.

Mutual Funds

- American Century Investments

- American Funds

- Fidelity Advisors

- Franklin Templeton Investments

- Invesco

- MFS

- Putnam

Annuities

- AIG

- Brighthouse Financial

- Equitable

- Lincoln Financial

529 Plans

- American Funds

- Fidelity Investments

- Franklin Templeton Investments

- Scholar’s Choice

401(k) Plans

- American Funds

- CUNA

- Equitable

- Fidelity Advisors

- Voya

- July Services Managed Account 401k Launch and Liberty

- July Services Cash Balance Plans

- ADP

- PayChex

Managed Accounts: Primerica Advisors Lifetime Investment Platform

Focused on Client’s Lifecycle Needs: The Primerica Advisors Lifetime Investment Platform is designed to enable advisors to assist their clients in achieving goals throughout the client’s investable lifecycle. Advisors can assist clients through the accumulation, preservation and income distribution phases of their lives.

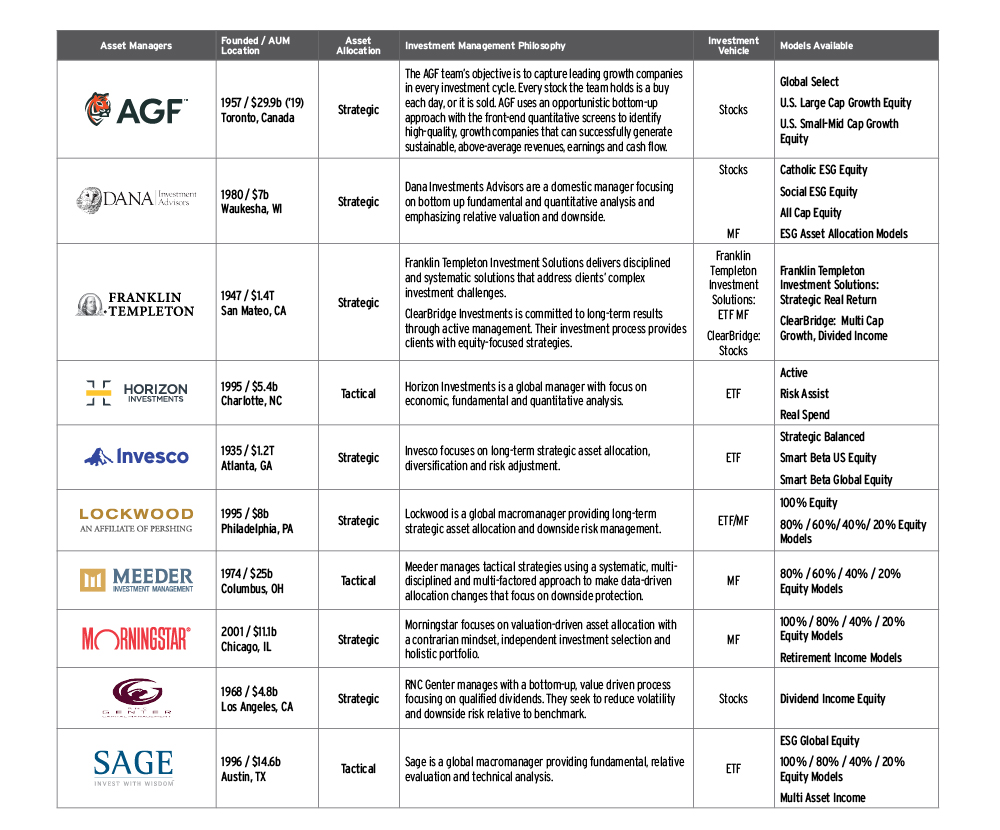

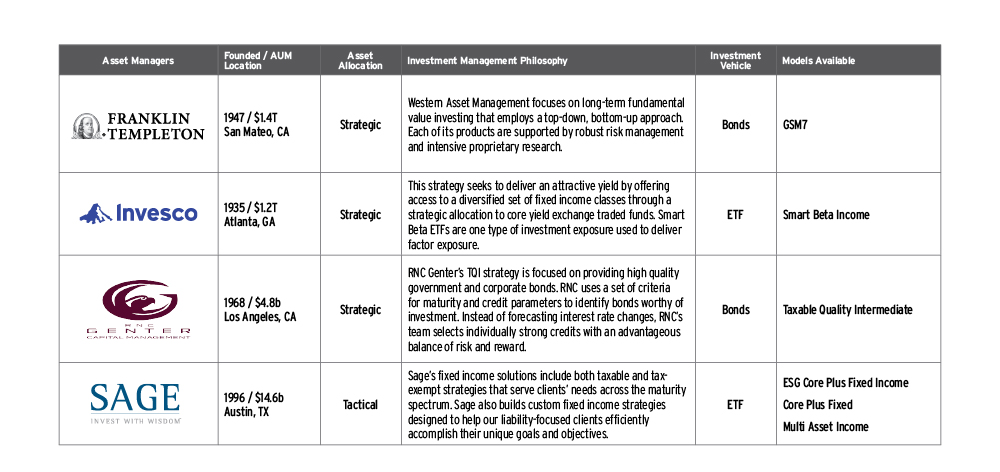

Access to Professional Asset Managers: The platform provides access to professional asset managers who have well-established track records in asset allocation and security selection, including exchange traded funds, mutual funds and individual stocks and bonds. Each asset manager was selected based on their people, philosophy, process and performance.

LIFETIME INVESTMENT PLATFORM

EQUITY OFFERINGS AND ASSET ALLOCATION MODELS

TAXABLE FIXED INCOME OFFERINGS

TAX MANAGED OFFERINGS

The below descriptions are the types of Tax-Managed Offerings Available. These offerings are available for Non-Qualified Account Registrations.

| Tax-Exempt | These strategies are focused on generating tax-exempt income through direct ownership of municipal bonds, or through ownership of Exchanged Traded Funds that hold municipal bonds. |

| Tax Aware | These strategies invest in mutual funds that seek to reduce capital gains tax exposure by limiting turnover of equity securities and reduce income taxes through municipal bond holdings. |

| Tax Loss Harvesting | Managers will actively monitor gains and losses associated with individual stocks and will harvest losses (sell) to offset gains and limit capital gains taxes. |

The individuals identified as EHR Financial are affiliated with Primerica, and offer products and services through Primerica subsidiaries, including Primerica Life Insurance Company and PFS Investments Inc.

A Primerica representative’s ability to offer products and services is based on the licenses held by the individual, and the states in which the individual is registered. Not all representatives are authorized to sell all products and services. For additional information about a representative, including licenses and state registrations, please visit www.BrokerCheck.com.

PFS Investments Inc. (PFSI) offers both brokerage and advisory accounts. Representatives do not have investment discretion over any client account or assets. For additional information about the products and services available in brokerage and advisory accounts, including fees, expenses and the compensation received by PFSI and your representative, please review a copy of our Form CRS, Form ADV brochure and our informational brochure, Investing with Primerica, available from your representative and online at www.primerica.com/pfsidisclosures.

Securities offered by PFS Investments Inc. (PFSI), 1 Primerica Parkway, Duluth, Georgia 30099-0001, a broker-dealer and investment adviser registered with the Securities & Exchange Commission (SEC), a member of the Financial Regulatory Authority (FINRA) [www.finra.org] and a member of the Securities Investors Protection Corporation (SIPC) [www.sipc.com]. PFSI’s advisory business is conducted under the name Primerica Advisors. Fixed indexed annuities are offered by Primerica Financial Services, LLC (PFS). PFSI, PFS and Primerica Inc. are affiliated companies.

The Lifetime Investment Platform is an advisory program sponsored by Primerica Advisors. For additional information about Primerica Advisors, please ask your representative for a copy of the Lifetime Investment Platform Form ADV brochure.

Mutual funds, annuities, 529 plans, 401(k) plans and asset managers referenced above are made available through contractual relationships between PFSI and the product providers.

Investors should carefully consider the investment objectives, risks, charges, fees and expenses of any mutual fund before investing. This and other important information can be found in the fund’s prospectus and, if available, the summary prospectus. Please read the prospectus and, if available, the summary prospectus carefully before investing. Prospectuses are available from your Primerica representative.

This material is for informational purposes only and should not be considered investment advice or a recommendation to buy, sell or hold a security.

Primerica representatives are not financial or estate planners, or tax advisors. For related advice, individuals should consult an appropriately licensed professional.

Investing entails risk including loss of principal. Past performance is no guarantee of future results.

EHR Financial’s Offices: